What is Remittance Advice? Everything You Need to Know

This article discusses remittance advice, its associated challenges and how to resolve them.

Remittance advice is an essential part of maintaining accurate records for any accounting team. Essentially, it ensures that you are accurately able to match incoming payments and the right invoices. However, although it sounds straightforward, interpreting remittance advice could be challenging. This is especially so due to a lack of standardization across board.

Today, companies have no standard format for remittance and are left to design theirs. Therefore, Account Receivable (AR) staffs have to do the matching manually. Despite this pressing challenge, there are ways to simplify remittance advice.

This article discusses remittance advice, its associated challenges and how best Account Receivable teams can resolve it.

What is the Meaning of Remittance Advice?

Remittance advice simply refers to the description a customer provides along with a payment that indicates to the supplier what that specific invoice is all about. It is derived from the popular finance term, “Remittance”, which means a payment made for goods and services or quite literally send back.

Remittance advice refers to giving additional details to a payment you make and could also serve as a confirmation that a payment is on its way. Remittance advice is also referred to as a payment/ remittance voucher or remittance slip.

Why is Remittance Advice Important?

Remittance advice is important because it acts as a proof of payment document on behalf of a customer to a business. Generally, it is tendered when a customer wants to inform a business of an invoice that was paid. This makes it equivalent to cash register receipts in a sense, but from the customer to the business instead of the other way around.

Is Remittance Advice a Proof of Payment?

Remittance advice differs from proof of payment as it only indicates that a payment has been sent. Proof of payment confirms that the payment has been sent and received by the intended party. Remittance advice may be valid but there are things that can go wrong during the transfer process and the money fails to reach the intended party. In such a situation, remittance advice that is taken as proof of payment will become void as the payment did not go through.

This is why auditors do not consider a remittance slip as a confirmation of payment receipt. Instead, they rely on the actual bank statement for proof of payment.

Nevertheless, a remittance slip offers helpful information pending the payment receipt as it indicates the payment dates and relevant transaction receivables.

What are the Information Contained in a Remittance Advice?

There is no specific standard on the type of information required for a remittance slip. Instead, it depends on the specifics of the transaction and what the payment was used for.

On a foundational level, remittance advice should contain:

· Invoice date

· Invoice number

· An email address (for remittance sent via email)

· Payer and payee names

· Payer and payee contact details

· Payment method and currency

· Payment amount and specific dates

· Description of the payment products or services

· Purchase order number

More detailed remittance advice slips may also include:

· Amount withheld

· Payment reference number

· Deductions

· Gross and net amounts

· Paper document number

· Applied discounts

How Can I Create and Send Remittance Slips?

Ideally, remittance slips are generated by the Accounts Payable (AP) department and forwarded to the appropriate channel. Remittance advice can be sent through any of the following means:

· Electronic data interchange (EDI)

· Account payable portal

· Paper document via physical mail (snail mail)

· Via check

· Excel sheet

· Email content or as an attachment via mail

Due to the advancement in technology, the Account payable portal is the most commonly used closely followed by email. This is because other businesses can easily integrate their platform and existing workflow with an AP system.

What are the Two Types of Remittance Advice?

The two types of remittance advice include:

1. Paper Based Remittance

Just as the name implies, paper-based remittance advice is paper-based documents that are printed or handwritten. They include invoice number payment amount, goods and services paid for and other relevant details

2. Email Remittance

Email remittances, on the other hand, are more or less the same as regards information but are sent via mail by the customer instead of being printed or written on paper.

Remittance Advice Example – What does it Look Like?

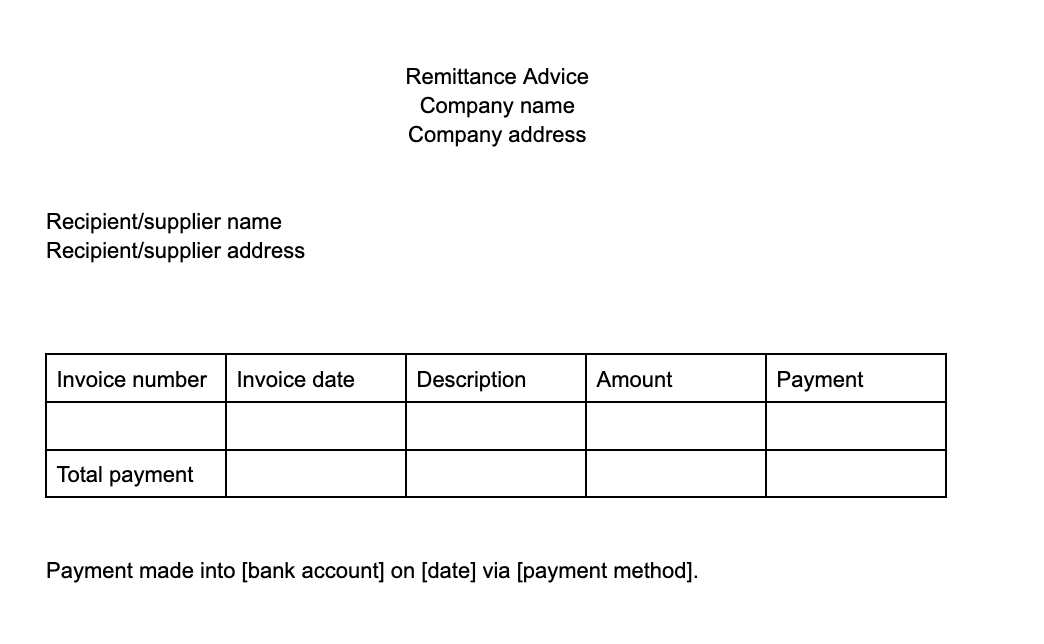

Remittance advice generally provides information about the invoice being paid by the payer as well as the respective amount per payment. Information provided by the payer through the remittance advice is then used by the AR department to update their records and match the respective payments to the right invoices.

Below is a sample of what a remittance advice template looks like:

What are the Challenges Associated with Remittance Advice?

The major challenge faced when dealing with remittance advice is in the AR department trying to manually match advice with invoices. Problems encountered include:

1. Desperate Entries and Formats

Depending on how busy a business is, receiving remittance advice from several customers involves handling desperate entries and formats. This is because there is no standard format for remittance advice, therefore physical advice may arrive in checks while wiring transfers via mail. This may cause confusion during tracing as different remittance advice may arrive in separate formats.

Essentially, the AR department may often need to contact customers for clarification. Remittance advice may typically become difficult to track and match to invoices as a business scales.

2. Potential Fraud

Remittances can be used to perpetuate fraudulent activities too. From blurry words to missing characters and intentionally bad writing, the process of matching remittance slips with necessary invoices and receivables can be very difficult. Fake remittance may often slip through the cracks.

3. Complex Remittance Matching

The process of matching remittance advice itself is complicated. One payment could be for over 100 invoices with several invoices being short-paid depending on the pre-agreed arrangement and sometimes, there could be no remittance advice sent in at all.

Matching remittance advice with issues like this could quickly become complex and lead to several back and forth between the AR department and customers.

Solving Remittance Advice Challenges With Digital Infrastructure

Digital remittances are growing rapidly in functionality and market adoption, posing a strong alternative to conventional remittance advice challenges. It offers a lower fixed cost, easy matching and resolution of advice and more transparency.

SanaTransfer offers easy, fast and secure payment services with better rates and faster payouts for international remittance. Sign up now to get started.